In my previous posts on Tips on how to stick to your Budget, How to Budget Properly, Managing your Finances and Best Tips and Tricks for Budgeting, I talked generally about finance and money. In this post, I want to share with you how to live a frugal life.

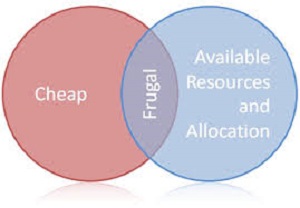

Frugality is the quality of being frugal, sparing, thrifty, prudent or economical in the consumption of consumable resources such as food, time or money, and avoiding waste, lavishness or extravagance. Wikipedia. While being frugal does not mean you can not give yourself a treat from time to time, it is completely different from being cheap, miserly or stingy. Although others are of the opinion that instead of being frugal, you should work hard and earn more. The truth is that if you are not able to learn to manage #1,000.00 then it is almost impossible for you to be able to manage #100,000.00. So, even if you focus more on earning more money, you will never be content as your needs and wants increase as your income increases. It is better to know the basics of budgeting and frugality, so you can give yourself and your health a break from all struggles that seem never to end.

Here are ways to be Frugal

1 Prepare a Budget: Budgeting is the first step to take when being frugal because it helps you keep track of your expenses on a weekly, bi-weekly or monthly basis. Budgeting simply means trying to fit in all your expenses into your monthly earnings, taking into consideration the most and least important (Scale of preference).

2 Cut your accommodation cost: The major challenge I believe everyone who is an adult who is not living in his/ her own house has is accommodation problem and it does not matter whether you are single, married or a squatter. You may need to look for a cheaper accommodation than where you are now if you fall in the category of those who would rather squeeze themselves in a tiny house in the city center than live a comfortable life in the suburban areas or if your accommodation cost exceeds 20% to 30% of your annual earnings.

3 Be Health Conscious – Invest in your Health: Health they say is Wealth. It is only someone who is alive and healthy that can work and make wealth. Rather than spend your money on junk foods and frivolities, invest them on fruits, vegetables, good food supplements and eat more fish than meat. Exercising from time to time will also do you a lot of good and you won’t have to spend huge amounts on hospital bills.

4 Buy items from the thrift store and open markets: There is no doubt that items purchased from stores are more expensive than those in the open market, especially food items. You may go to village markets to get your items at cheaper prices.

5 Buy in Bulk: Buying in bulk helps save a lot of not only money but time and energy. However, when buying in bulk, be sure to buy items that are not easily perishable because they will go bad before you are able to use them up. If you have to buy perishable food items in bulk, be sure to have a means of preserving them.

6 Buy fairly used items: Items like furniture, cars and some home appliances can be bought as fairly used items if you do not have the resources to go for brand new ones. Once bought, they can be refurbished and used but be sure to look well before you leap.

7 Cook your own food: By cooking your own food, you are not only able to save a lot of money, but you are also able to save your body from taking the junks out there. There was a day I ate out and what I had was egusi soup, I ended up not finishing my meal because of the amount of palm oil in the soup which would put me at the risk of high cholesterol (I am ordinarily a health-conscious person).

8 Buy only things you need: Refer to no. 1 that has to do with applying a scale of preference. This I learned in Economics since my high school. It simply means prioritizing your expenses. You do not want to buy an expensive phone whereas you are yet to pay your school fees or a debt you owe that accumulates interest.

9 Avoid loans and using credit cards: Loans with interest rates and credit card debts can add up real fast. It might seem like a little amount initially but you will be surprised at the total amount you have to pay at the end of the day. Use your debit cards or cash instead.

10 Do not buy your house on Mortgage: I used to be a fan of mortgaging a house as it seemed convenient, removes the pressure of having to save up all the money you need to buy your house at a go. But the truth is paying for a mortgage puts you in a more financial mess than you can think of, starting with the fact that the amount you start repaying takes care of the interest completely before the capital. So, you end up servicing the interest which keeps adding up for a long time while the capital remains untouched. Truth be told, in some cases, the interest on the property alone is enough to either buy another house outright or even build a house to your taste.

11 Avoid wastage: A lot of money is usually being wasted by tossing that food or snack that was left on the countertop overnight to go bad. Leftover foods should be refrigerated or frozen and can be eaten again as is or added to other meals. Money is also wasted on items that are purchased without really having a need for them and then they are abandoned. Use every last scrap of every last thing you purchase. Don’t waste anything. Don’t leave taps running, don’t throw out the quarter of a plate of dinner you didn’t eat.

12 Reduce your Utility Bills: There are several ways we waste money without realizing it. By putting off the switch when not in use and not leaving the tap water running while brushing will help cut our bills while saving our climate at the same time.

13 Grow your own food: Yeah, I know this might sound unrealistic but it is possible though not for everyone. If you have your own compound or backyard space, you can actually have a homestead where you grow your crops and animal proteins rather than planting flowers or leaving the entire place bare. But be sure to get approval from the authorities around you, if need be. You can just keep a mini garden where you run to for emergency bailouts.

14. Pack your own lunch: Spending #700 on a daily basis (Monday to Friday) on lunch means you would have spent #14,000.00 monthly. Even if this figure doesn’t seem much, saving the same amount on a monthly basis would add up to #168,000.00 at the end of one year.

15 Cut your cable TV cost: Are you paying a huge amount of money on cable every month? Why not subscribe to a smaller package or change your cable provider completely if you must keep using your cable. There are also cable TVs that are free to air but require a startup purchase cost.

16 Cut the cost of Entertainment: If you are the type that has a lot of friends and hangs out a lot, why not invite them over to your house and cook for them instead. That way, you have fun cooking together and saving a lot of money on feeding them than if you had gone out to eat.

17 Cut Newspapers, Magazines & Gym Subscription: I believe that there are some subscription that you may have signed up for but are not actually using. If there are any expenses in such nature, why not cut them off and have your money saved up for you rather than services you do not enjoy.

I hope these tips are able to help you begin your frugal journey. All the best and see you at the top! Please feel free to comment below, like and share.